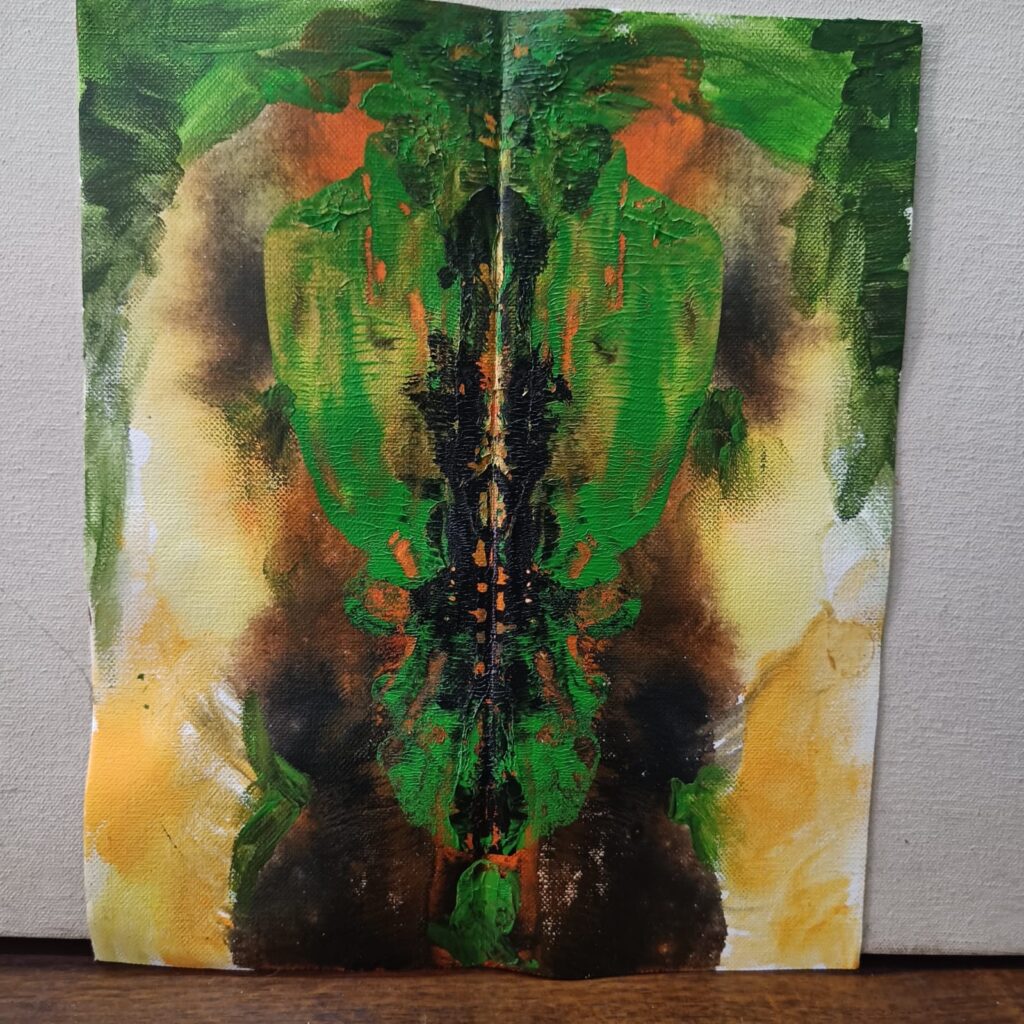

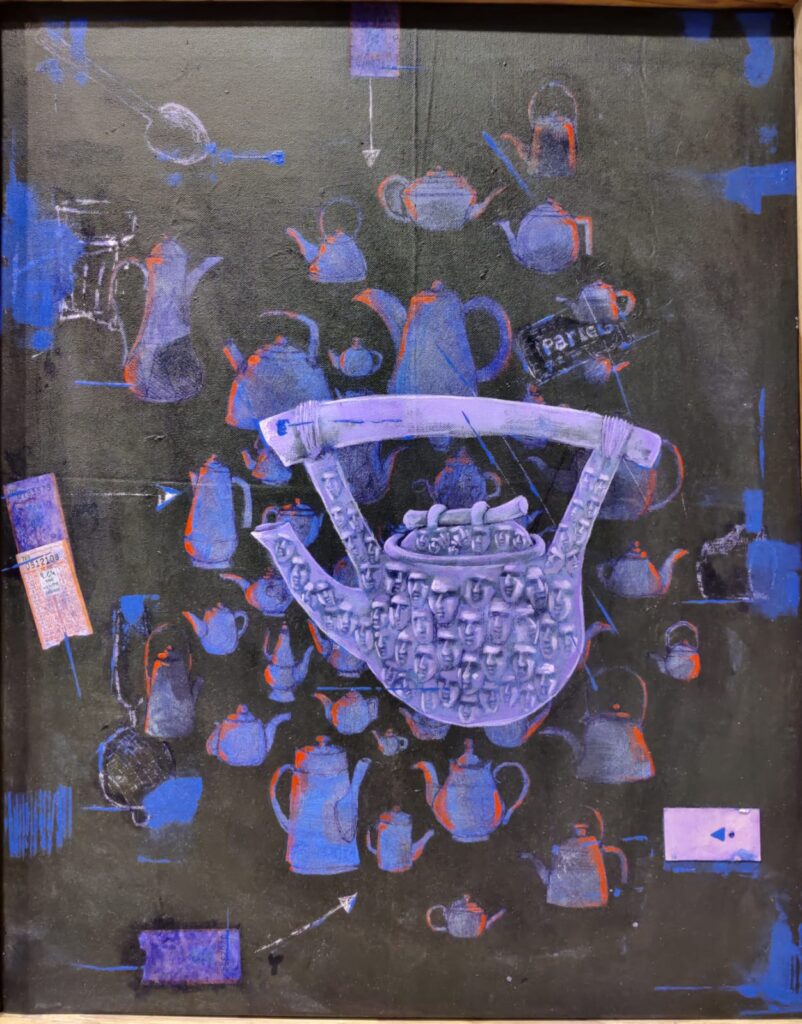

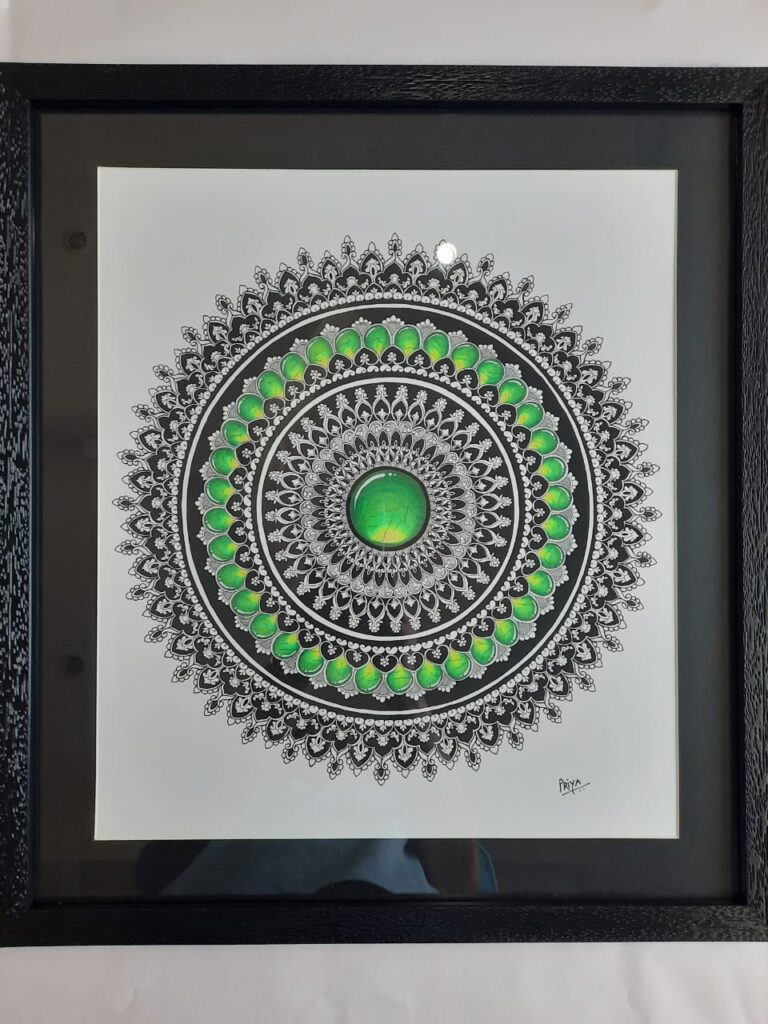

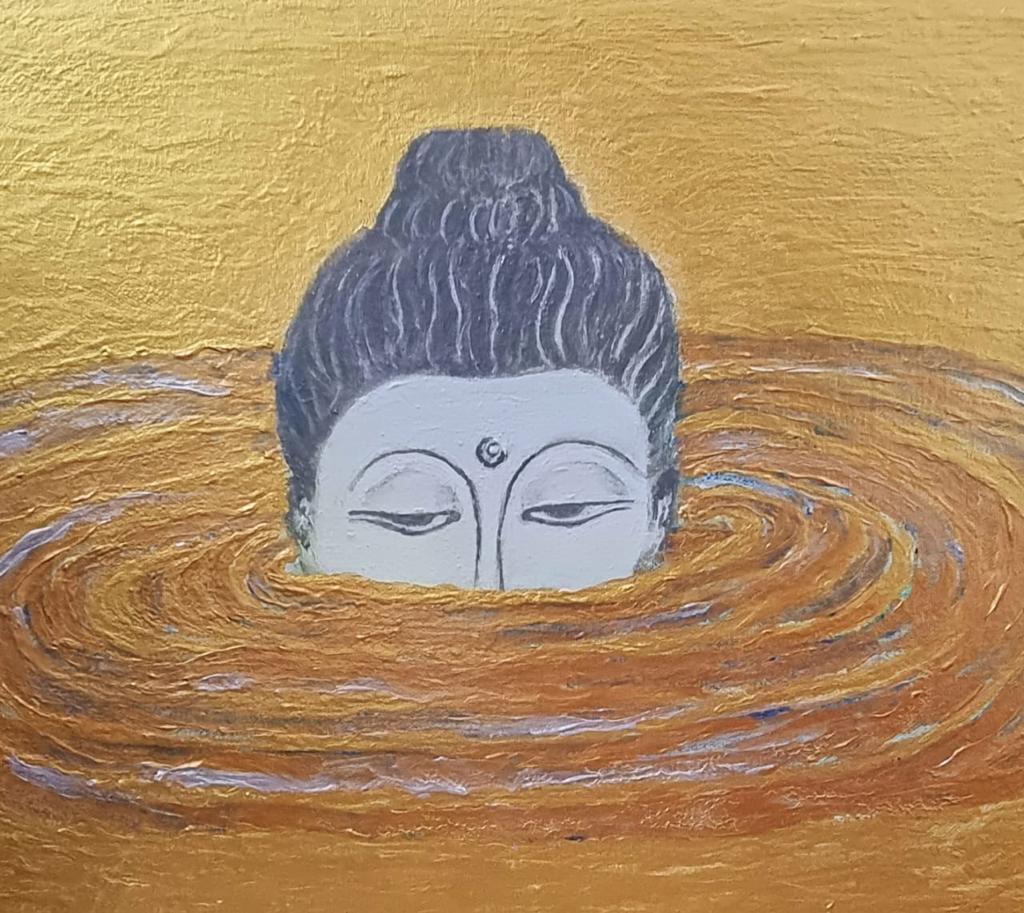

In the world of investments, there are the tried-and-true options like stocks and real estate. But for those who seek both financial gain and aesthetic pleasure, fine art paintings present an intriguing avenue. Beyond their aesthetic value, art pieces can appreciate significantly over time, making them a unique and potentially lucrative choice for investors. In this blog, we will delve into the investment potential of fine art paintings and why they should be considered as part of a diversified portfolio. Investment Potential of Fine Art Paintings

The Art Market: A Lucrative Frontier

The art market is a dynamic and often mysterious world, but it has consistently proven its investment potential. Here’s why:

- Historical Appreciation: Fine art has a track record of appreciating in value over time. Masterpieces from renowned artists like Picasso, Van Gogh, and da Vinci have sold for astronomical sums, with their values increasing manifold since their creation. These examples showcase the lasting appeal and enduring value of exceptional artworks.

- Portfolio Diversification: Including art in your investment portfolio can enhance diversification. Art’s performance often shows low correlation with traditional assets like stocks and bonds, which means it can act as a hedge against market volatility. When stocks stumble, your art investments may hold or even increase in value.

- Tangible and Enjoyable: Unlike financial assets that exist only in digital form, art is a tangible asset that can be enjoyed in your living space. This dual benefit of potential financial gain and aesthetic pleasure sets art apart from many other investments.

Understanding the Art Market

Investing in fine art paintings requires an understanding of the art market’s dynamics:

- Research and Expertise: Successful art investment begins with research and knowledge. Understanding the styles, periods, and artists that resonate with collectors and investors is crucial. Consulting experts or art advisors can be invaluable in making informed choices.

- Market Trends: Stay attuned to market trends and developments. Art markets can be influenced by factors like exhibitions, auctions, and the recognition of emerging artists. Being aware of these shifts can guide your investment decisions.

- Diversification: Just like any investment, diversifying within the art market is wise. Consider investing in different artists, styles, and time periods to spread risk and potentially increase the chances of a profitable return.

Factors Influencing Art Prices

Art prices can be influenced by factors such as an artist’s reputation, rarity of the artwork, provenance, historical significance, and current market demand.

Hedge Against Inflation

often considered a hedge against inflation because its value tends to rise over time, and it’s less susceptible to the erosive effects of inflation that can affect cash and bonds.

Emerging Artists and Investment Opportunities

Emerging artists can offer investment opportunities, as their works are often more affordable and have the potential to appreciate significantly if their careers take off.

The Role of Auction Houses in Art Investment

Auction houses play a crucial role in the art market, as they provide a platform for buying and selling artworks. High-profile auctions can set price benchmarks and attract collectors and investors.

Funds and Collective Investments

Art funds and collective investment vehicles allow individuals to pool their resources to invest in art. These funds are managed by experts who make art investment decisions on behalf of investors. The Investment Potential of Fine Art Paintings is vast

Challenges and Risks in Art Investments

Challenges and risks in art investment include the subjective nature of art valuation, market volatility, the potential for forgeries, and the illiquidity of art assets.

Diversifying Your Art Portfolio

Diversification within your art portfolio involves investing in different types of art, including contemporary, modern, and classical pieces, to spread risk and maximize potential returns.

Concluding The Investment Potential of Fine Art Paintings

The investment potential of fine art paintings cannot be overlooked. Beyond their aesthetic appeal, these tangible assets have historically appreciated in value, provided diversification benefits, and offered a unique investment experience. While investing in art requires careful research and understanding of the market, the potential rewards are as enriching as the art itself. As with any investment, it’s essential to approach art investment with a long-term perspective and a willingness to learn and adapt as the market evolves. So, consider adding a masterpiece to your investment portfolio and let your passion for art lead you to financial prosperity. to know more click here

Excellent

Thank you for giving us your appreciation; it motivates us.

I am thrilled and waiting for the exhibition.

It is really a high class exhibition being organized and I am happy to be part of it.

Thank you for giving us your appreciation; it motivates us.

Amazing artworks! Waiting for the exhibition eagerly.

Thank you for giving us your appreciation; it motivates us.

Very good insight on Fine Art investment options .

Investing in fine art paintings can be a lucrative venture, as the value of renowned artworks often appreciates over time. As with any investment, diversification and a long-term perspective are key to maximizing potential returns.

Great share ….

Thank you for giving us your appreciation; it motivates us.